3 important ways our financial planning boosts your financial wellbeing and happiness

June 2021

You’ll be familiar with the expression “money can’t buy happiness” and, according to a recent study, it’s true. Recent research carried out for pension and protection provider Aegon shows having the right attitude towards life is fundamental to being happy about money.

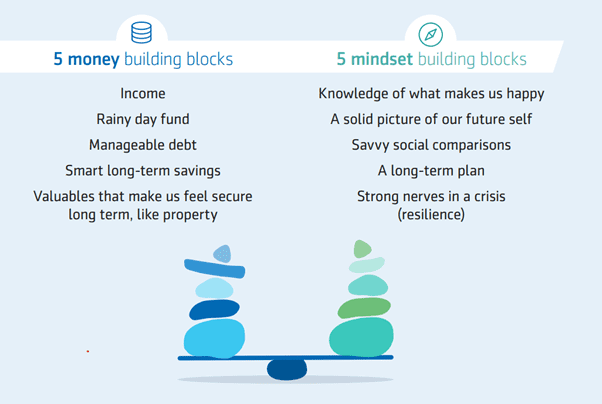

As the diagram below shows, Aegon suggests that to have peace of mind around money, you should develop two “building blocks”: one for finances and the other for your attitude to life, which the provider calls “mindset”.

Source: Aegon

The study, called the "Financial Wellbeing Index", not only measures people’s wealth, but also their feelings of worth, joy and happiness. As a result, researchers made the following three discoveries:

- One-third of top earners worry about money

- More than half of average earners (55%) also worry about money

- Only 4 in every 10 people consider what actually brings them joy.

For us, the study is extremely welcome and dovetails into what we call “Finding True Wealth”.

As you’ll know, we strongly believe that money is not just about possessions; it’s about providing the freedom you need to live life to the full and enjoy yourself.

Read on to learn what the right mindset is, and three ways we aim to help you achieve it.

The 5 money building blocks will be familiar, yet the mindset ones may surprise you

While four of the money building blocks are self-explanatory, the “valuables that make us feel secure in the long term” might be seen as a little vague. For clarity, it refers to having assets – such as property, savings and investments – that can help create long-term financial security.

As you’ll be familiar with the way we work with you to develop Aegon’s money building blocks, in the article we’ll turn our attention to the mindset building blocks.

Before we consider how we aim to use them in the work we do with you, we need to look at each one and understand what they actually mean. For ease, we have compiled the table below showing Aegon’s interpretations.

| Building block | Why it matters | What it means |

|---|---|---|

| Knowledge of what makes you happy | Only 4 in 10 people think about what gives their life joy and purpose | Experiencing equal amounts of joy and purpose every day |

| A solid picture of your future self | Just one-third of people have a concrete idea of their future self in mind | Having a firm picture of where you want to be in the future can help you get there |

| A long-term plan | Only 13% of people have a plan to achieve long-term money goals | People who write out a financial plan save regularly and do better financially |

| Savvy social comparisons | The younger we are, the more we’re likely to compare ourselves to others | Find suitable financial role models |

| Strong nerves in a crisis (resilience) | 14% of investors sold out last time they saw the stock market fall, even though this could leave them worse off | Getting professional financial help can help you manage your investments closely and provide resilience when needed |

Now that we’ve established what each mindset means, let’s look at how we work to help you achieve them and why we believe this is so important.

1. Financial wellbeing is about happiness, not having more

For us, the first building block, which centres on happiness, is particularly interesting. One finding by Aegon was that financial wellbeing is not necessarily about having “more”, but, instead, about understanding what makes you happy now and in the long term.

It points out that not taking time to see the joy in life, or appreciating your value to others, can result in feelings of stress around money. Below is another table from the research, showing how few people actually take the time to consider what brings them joy and a sense of purpose in life.

| Age group | Percentage of people who said they’d given “a lot” or “quite a lot” of thought to what brings them joy and purpose |

|---|---|

| 65 – 74 | 35% |

| 55 – 64 | 42% |

| 45 – 54 | 36% |

This is why we work with you to identify the things in life you want to do more of, be that traveling, spending time with loved ones, gardening or a hobby. By helping you focus on this, we aim to ensure you continue to do the things that bring you pleasure, joy and a sense of purpose, both today and into the future.

In addition, our service to you is to provide you with counsel on your financial situation. As the report highlights, earning more is not necessarily the route to happiness and peace of mind.

Indeed, it can result in more stress and less time to enjoy the very things you can afford to purchase with your higher income. That’s why we not only look at the growth potential of your investments, but also your outgoings and tax efficiency, as reducing these could boost your lifestyle and happiness without the stress that can come with a higher paid role.

2. Having a financial strategy is critical to achieving financial peace of mind

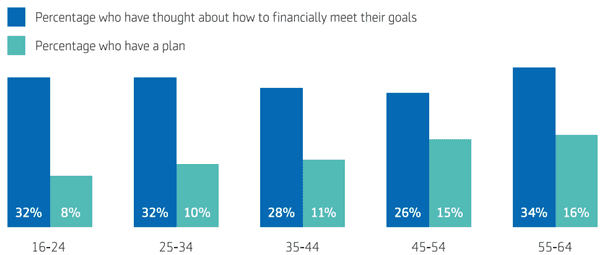

It’s no surprise to us that having a “solid picture of your future self” and “a long-term plan” feature in the mindset building blocks. As the graph below shows, despite the fact that a strategy can increase the chances of achieving goals, many people across all age groups fail to produce one even though they think about the future.

Source: Aegon

Creating a strategy is fundamental to the work we do with you as we understand its importance. It helps you focus on where you want to be in 5, 10, 15 and 20 years from now, enabling you to make decisions your future self will thank you for.

This is why we build financial models for you that aim to create a picture of your future life and how it will look in terms of finances. By doing this, we provide a context for your decision making today that can positively impact your future life.

3. Working with us helps your nerves when the markets take a downturn

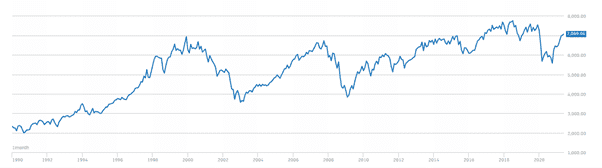

Over the last 18 months you may have heard us say that, if you’re on a rollercoaster that’s too scary for you, the time you should never get off is part way through. When the markets are volatile, as they have been during the pandemic, this is how you should think about your investments. Making a knee-jerk reaction to a downturn in the markets is something you may well later regret, and something we aim to help you avoid by being there for you.

As the following chart from the London Stock Exchange shows, the long-term trajectory of the FTSE 100 is up despite a number of downturns along the way – such as the 2020 downturn in the wake of the pandemic.

Source: London Stock Exchange

By helping you understand why the funds you’re invested in have taken a downturn, you’re better placed to feel confident about your long-term investment strategy and make a considered, thought-out decision – not a knee-jerk reaction to bad news.

This dramatically reduces the chances of feeling regret later and provides you with the confidence to make better decisions around your wealth.

Get in touch

If you would like to discuss your wealth and investments, or have a conversation about how we can help you achieve greater peace of mind around your finances, contact us below.

Please note

This article is for information only. Please do not act solely based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change. Investments can fall as well as rise, and past performance may not be a reliable guide to future results.